The UK housing market has undergone significant changes in recent decades, shaped by a variety of economic, social, and political factors. Traditionally, buying a home has been seen as a crucial milestone in adult life, often regarded as a sign of financial stability and personal success. However, for many aspiring homeowners, this goal has become increasingly difficult to achieve. In particular, the age at which people buy their first home has been steadily rising, reflecting broader shifts in both the housing market and society.

First-time buyers have long been a crucial part of the property ladder in the UK. They represent the entry point into home ownership, supporting market liquidity and ensuring the continual flow of property sales. A strong first-time buyer market is not only important for individual wealth-building but also for the overall stability and growth of the housing sector. Their ability to purchase homes has a knock-on effect on the entire market, influencing everything from house prices to the availability of rental properties.

However, the average age of first-time buyers has steadily increased. Several key factors have contributed to this trend, including the rising cost of housing, stagnant wages, and changes in societal attitudes towards home ownership. Economic pressures, such as the increasing difficulty of saving for a deposit, coupled with soaring property prices, have meant that many people are delaying their first property purchase for longer than previous generations. Alongside these economic factors, cultural shifts—such as prioritizing education, career development, and travel before settling down—have also played a role in the decision-making process. The impact of government policies, like the introduction of Help to Buy schemes and other first-time buyer initiatives, has also influenced how and when people can afford to buy their first home.

Historical Trends in First-Time Buyer Age

The age of first-time buyers in the UK has changed significantly over the last few decades. In the 1980s and 1990s, it was not uncommon for people to purchase their first home in their mid-to-late 20s. This was largely due to a combination of more affordable housing, lower house price-to-income ratios, and the availability of mortgage products suited to first-time buyers. Back then, housing was seen as a natural step in the life course, especially for those with stable jobs and good financial prospects.

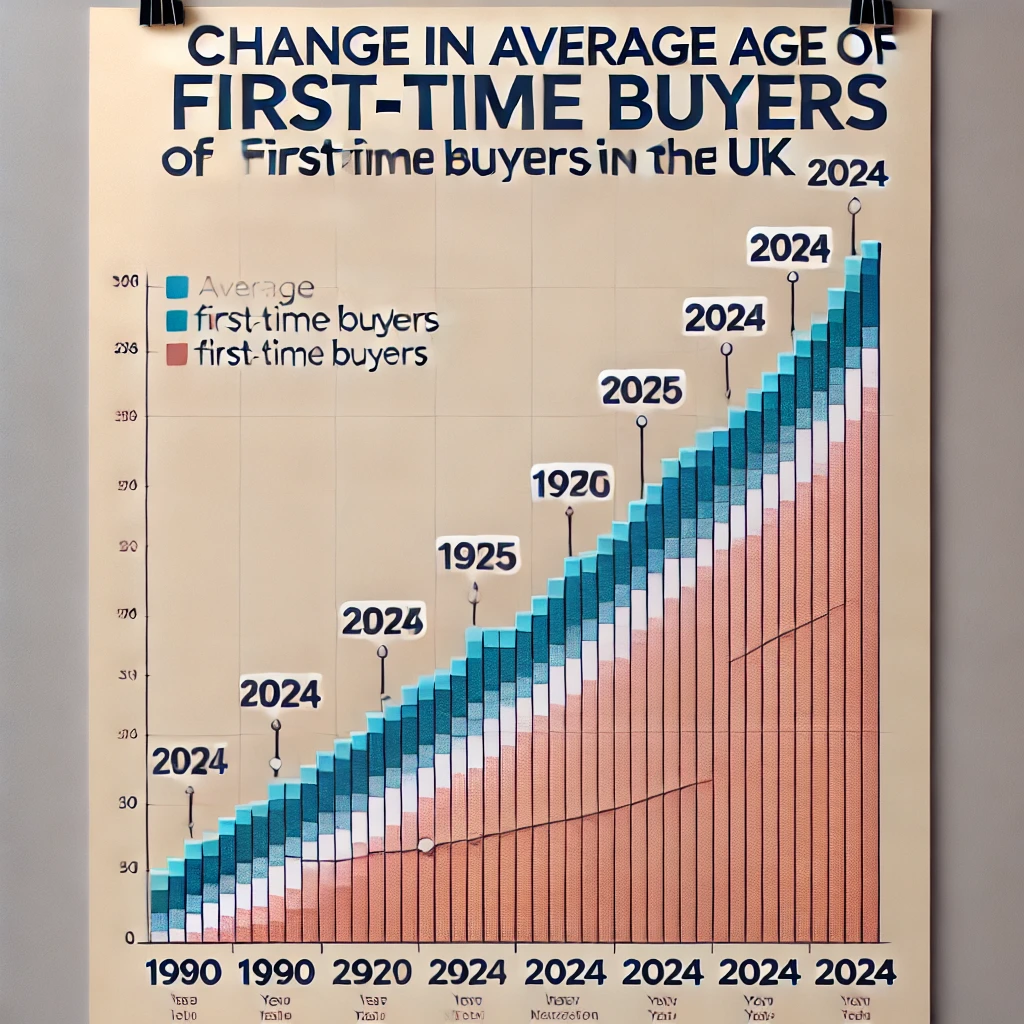

However, as we moved into the 2000s, particularly following the 2008 global financial crisis, the trend began to shift. The average age of first-time buyers began to increase steadily, and by the 2010s, it had reached 33. Several factors contributed to this change, notably rising house prices and tighter mortgage lending criteria, which made it more difficult for younger people to enter the housing market. Economic shocks like the financial crisis also disrupted the availability of credit and slowed economic recovery, further delaying first-time homeownership.

Comparing the age of first-time buyers over time reveals stark differences. In the post-war era, house prices were much lower relative to incomes, and the economic boom that followed allowed many to secure their first homes at a younger age. Fast-forward to the present day, and the typical first-time buyer is often in their 30s, with many choosing to rent longer before they make the leap into home ownership.

Factors Contributing to the Shift

Several factors have contributed to the shift in the age of first-time buyers, with economic, social, and government-related influences all playing a role.

Economic Factors:

- Rising House Prices: One of the primary reasons for the delay in first-time homeownership is the significant increase in property prices, particularly in urban areas like London. Over the past few decades, house prices have far outpaced wage growth, making it increasingly difficult for younger buyers to save enough for a deposit and afford monthly mortgage payments.

- Changes in Mortgage Lending Policies: In the aftermath of the financial crisis, mortgage lending became much more stringent. Lenders imposed stricter requirements on borrowers, including larger deposits and higher credit score standards. This made it particularly challenging for first-time buyers, who often lack the equity or credit history to secure favorable mortgage terms.

- Wage Stagnation and Cost of Living Increases: While housing costs have risen, wages have not kept up with inflation, particularly for younger generations. The cost of living has also increased, including factors like rent, transportation, and everyday expenses, leaving little room for savings. As a result, many potential first-time buyers find themselves struggling to accumulate the funds needed for a home.

Social Factors:

- Shifts in Societal Priorities: Younger generations tend to prioritize different milestones compared to their predecessors. Many individuals are waiting longer to marry, have children, or settle down, focusing instead on education, career advancement, and travel. These shifts in life priorities mean that purchasing a home often takes a back seat until later in life.

- Later Life Milestones: Traditionally, homeownership was linked with starting a family. Today, many people delay major life events, such as getting married or having children, which in turn delays their decision to buy a home. Many prefer to rent until they have a clearer sense of financial stability and life direction.

Government Policies:

- Impact of Policies Like Help to Buy and Shared Ownership Schemes: Government initiatives, such as Help to Buy, were introduced to help first-time buyers get onto the property ladder. While these schemes have made homeownership more accessible for some, they have also raised concerns about inflating house prices and making homes unaffordable for others. Shared ownership schemes, where buyers purchase a portion of a property and pay rent on the remainder, have also gained popularity but come with their own set of challenges.

- Influence of Tax Changes and First-Time Buyer Incentives: Policies like stamp duty cuts for first-time buyers in certain price brackets have provided some relief. However, these incentives have not fully counteracted the broader economic pressures that continue to push the age of first-time buyers higher.

Regional Variations in the Average Age

The age of first-time buyers varies significantly across the UK, influenced by both regional economic conditions and housing market dynamics. In London and the South East, house prices are considerably higher than in other regions, pushing the average age of first-time buyers well into the 30s. These areas have seen a greater proportion of people renting for longer periods or moving to more affordable areas further from the city center.

In contrast, first-time buyers in the North, particularly in cities like Manchester, Liverpool, and Leeds, tend to be younger, as housing is more affordable. While prices in these areas have also risen in recent years, the relative affordability compared to the South allows buyers to enter the market at a younger age.

Rural areas across the UK also exhibit unique trends. In some countryside locations, particularly in Scotland and Wales, the cost of housing is lower, which can enable first-time buyers to purchase property earlier. However, limited job opportunities and smaller property markets in these regions can make it harder for first-time buyers to secure employment or finance.

Impact on the Housing Market and Society

The rising average age of first-time buyers has had significant implications for the UK housing market. One of the most noticeable effects is the growing demand for rental properties, particularly in urban centers. As fewer people are able to purchase homes, more are turning to renting, which has driven up rental prices, particularly in cities with high demand.

The delay in homeownership also has broader societal consequences. Homeownership is often seen as a way to build wealth, and the longer it takes to buy a home, the later individuals can start building equity in a property. This trend may lead to generational wealth gaps, with younger generations having fewer assets compared to older generations. Furthermore, the inability to buy homes may increase reliance on state-supported housing, putting additional strain on public resources.

Future Outlook

Looking ahead, the age of first-time buyers is expected to continue rising, though government intervention and market conditions may shift the trend in unexpected ways. Housing prices may remain high in many parts of the country, particularly in high-demand areas like London, but new policies aimed at reducing inequality in housing could help make homeownership more accessible.

There is also the potential for technological advancements and alternative housing solutions to alter the housing landscape. Innovations like co-living spaces, modular homes, and online platforms that help first-time buyers navigate the property market could lower costs and make it easier for younger buyers to enter the market. These solutions may provide a new model of affordable living that could change the traditional notions of homeownership.

Additionally, future government policies—such as further stamp duty relief, rent-to-own schemes, or increased housing supply—may also influence the trends. If wages increase or the cost of living becomes more manageable, we may see a reversal in the trend, with younger people returning to the housing market sooner.

The future of first-time buyers in the UK is uncertain, but it is clear that the age at which people purchase their first homes will continue to be influenced by a complex mix of economic, social, and political factors. What is certain, however, is that addressing the challenges of affordability and accessibility is crucial for the health of the housing market and the wider economy.

Conclusion

The changing age of first-time buyers in the UK reflects a broader shift in the housing market, driven by a combination of economic, social, and policy-related factors. Over the past few decades, the rising cost of housing, stagnant wages, and stricter mortgage lending have all contributed to delays in homeownership. Today, the typical first-time buyer is older than in previous generations, often entering the property market in their 30s rather than their 20s.

The shift in the age of first-time buyers has had wide-ranging effects on both the housing market and society. Increased demand for rental properties has pushed up rental prices, while the delayed entry into homeownership has meant that many are missing out on the opportunity to build equity and long-term wealth through property ownership.

Looking to the future, the outlook for first-time buyers remains uncertain. While government initiatives like Help to Buy and shared ownership schemes have provided some relief, they have not fully addressed the underlying affordability issues. As housing prices continue to rise, young people may still find it challenging to get on the property ladder without significant changes in market conditions or policy.

However, there is hope that innovative housing solutions, such as co-living spaces and rent-to-own schemes, along with potential changes in government policy, could provide more opportunities for younger generations. By addressing the affordability crisis and making homeownership more accessible, the UK can create a housing market that allows first-time buyers to achieve their dreams of owning a home at a younger age.

The average age of first-time buyers has steadily risen over the years, influenced by a complex mix of economic pressures and societal shifts. The need for continued policy reform and innovative solutions is clear, and it will be important for future generations to have the opportunity to enter the housing market at an age that aligns with their aspirations and financial reality.